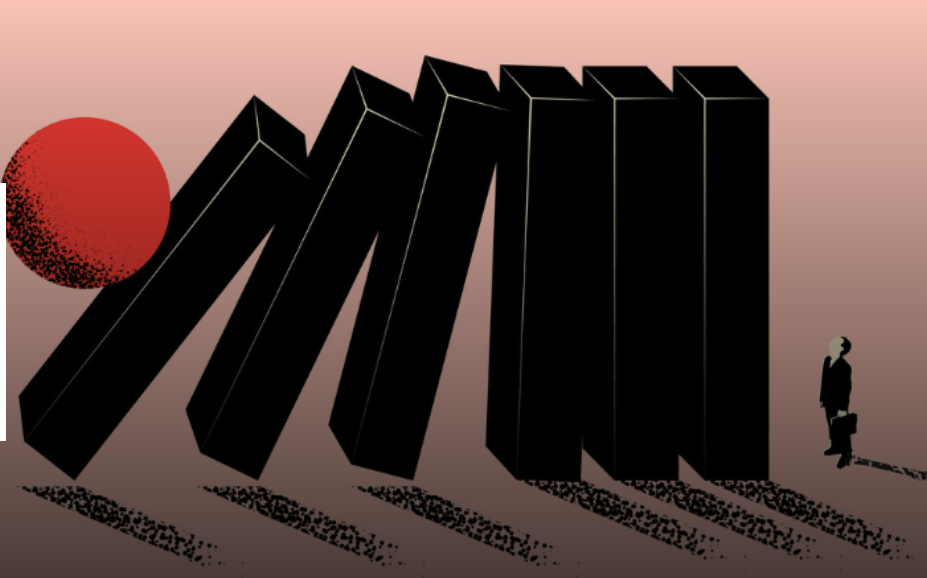

2022 has been a rough ride for crypto and NFTs. With a broader market downturn outside the crypto world and a deepening winter freeze within it, the Web3 low points of the past year reached new depths. From rug pulls to the collapse of tokens, crypto exchanges, and hedge funds, billions of dollars were wiped from the ecosystem, with regulatory and criminal investigations ramping up in response.

But success isn’t nearly as interesting as failure — every bad moment that happened this year taught us something valuable in the process. And with more than a decade of history to Web3’s name, it’s worth remembering that the ecosystem is still nascent. Part of building its future necessarily involves missteps, both the honest and malicious varieties. Ultimately, the takeaways from this year’s low points — and there were several — could make Web3 a better place in the end. With that in mind, we’ve gathered some of the year’s unforgettably worst moments, to see what they taught us.

Frosties gets the DOJ’s attention

2022 saw some of the biggest rug pulls in the NFT space’s history. Rug pulls are schemes that happen when crypto or NFT project developers draw in community members (and their funds) and then quickly abandon the endeavor, disappearing entirely and leaving a community with little or no legal recourse.

In January, the NFT project Frosties, an ice-cream-themed collection of 8,888 NFTs that marketed itself as a “cool, delectable, and unique” project, rug pulled its community to the tune of 335 ETH (more than one million dollars at the time) after minting out in just a few hours. Founders Ethan Nguyen (known as “Frostie”) and Andre Llacuna (known as “heyandre”) had built up a respectable community in their Discord and had promised collectors merch, raffles, and a treasury to ensure the longevity of the project. Post-mint, the project website and Discord vanished, and the funds from the sale were moved to various wallets.

While the community never recovered the stolen funds, they were able to feel that justice was satisfied when, in March, prosecutors from the Southern District of New York arrested and charged Nguyen and Llacuna with conspiracy to commit fraud and conspiracy to commit money laundering. While the case remains ongoing, it’s widely regarded as the department’s first NFT rug pull bust, representing a significant moment in NFT history.

Lessons learned:

The fallout from Frosties’ rug pull did two things: It reminded NFT enthusiasts just how diligent they need to be when researching and investing in NFT communities, and it served as a stark warning to would-be scammers that such actions were not beyond the reach of regulatory and enforcement bodies. When nft now spoke to IRS Criminal Investigation New York earlier this year regarding such instances, its agents made it clear that they were significantly ramping up their skills as cyber investigators to address blockchain-based cases of exactly this nature. Crime doesn’t pay, folks.

Pixelmon rug pull redemption arc

The Pixelmon NFT project has a wild history. While it doesn’t fit the exact description of a rug pull, it inhabits a similar space, serving as a valuable lesson on hype and credibility in the NFT community. The project, consisting of 10,005 pieces of pixelated character NFTs, launched on February 7, 2022, after having built up a mountain of expectations around its collection and future ambitions.

Pixelmon promised its community a AAA open-world-style adventure game set in a Pokemon-esque universe. Its founder, Martin van Blerk, promoted the team behind the project as all having worked for companies like Disney and Activision, which raised hopes that, once revealed post-launch, the NFT art would be something unique. Such feelings were reinforced when the Pixelmon team announced the mint would be styled as a Dutch auction starting at a hefty 3 ETH.

The 8,079 NFTs in the primary sale sold out within an hour of the project launch, with most collectors paying the full 3 ETH price tag. When all was said and done, the Pixelmon team had pulled in 23,055 ETH — more than $70 million. Soon after, however, community fears began to surface, as details about the team’s identities and the metaverse game they were building remained suspiciously light. Compounding this was the fact that the NFT art still hadn’t been revealed. Secondary sales fell to roughly 1 ETH just hours after the launch.

When the art was finally revealed to the community on February 16, collectors were distraught. The pixel art looked amateurish, even glitchy and nonsensical. The promise did not match the delivery, and community members felt they had the rug pulled out from under them. Further adding to this fear were accusations that van Blerk took funds from the project to go on a blue-chip NFT shopping spree where he acquired Bored Apes, Azukis, CloneX, Invisible Friends, and other highly-valuable NFTs. The floor price tanked, and Pixelmon was dead in the water.

But here’s where it gets interesting: Martin van Blerk didn’t abscond with community funds. He kept a low profile in the months after the project’s ruin, seeking help from investors who’d be willing to take on the task of rebuilding it. He eventually found one in Giulio Xiloyannis, Co-Founder of the Web3 VC studio LiquidX. Since taking the reins in late spring, Xiloyannis has put in some serious work rebuilding trust in the project, and despite everything that came before, the Pixelmon community has largely responded with enthusiasm. Pixelmon’s floor currently sits at 0.368 ETH, a number that’s a far cry from the project’s heyday, but a respectable bounce back given the circumstances.

Lessons learned:

Pixelmon still has a ways to go to prove itself worthy of the community it once wronged so deeply, but it’s doing an admirable job so far. Speaking to nft now in early October, Xiloyannis underscored a few things about the project’s history, notably that he got the impression that van Blerk had acted less out of malice and more out of inexperience. While the broader NFT community was right to lambast the project for its failures, Pixelmon has so far shown that redemption after a rug pull is at the very least a possibility. The optimism and dedication that its new CEO has shown over the last six months is not something to scoff at, no matter the project’s history. Pixelmon’s story shows just how vital it is to hold to meaningful virtues in a space where people are so deeply jaded from the destruction caused by scams and bad actors.

Axie Infinity’s $615 million hack

On March 23, hackers from the Lazarus Group and APT38 (organizations with ties to the North Korean government), successfully attacked the Ronin Network, the system that supports Sky Mavis’ popular play-to-earn game Axie Infinity. The groups were able to carry out fraudulent withdrawals from the network of $25 million in USDC stablecoin and 173,600 ETH for a total of more than $615 million, making it the largest hack in the network’s history and surpassing the $611 million hack of the Poly Network in August 2021.

The hackers were able to execute the attack by exploiting the Ronin chain’s validator nodes, managing to gain control of four of the nine Ronin Validators as well as a third-party validator operated by Axie DAO. In doing so, they fooled the system into thinking its withdrawals were legitimate. When the Ronin team realized what had happened, they paused the network, disabling transactions for a period of months before restarting transactions in late June.

In the three months after the attack, Axie players retrieved whatever lost funds they had stored on the Ronin Network via a Binance-provided bridge, with Sky Mavis covering the entirety of players’ losses. However, 56,000 ETH taken from the Axie DAO’s treasury is still unaccounted for. If these funds remain unrecovered for two years, the Ronin team explained in a blog post, a vote will be called within the DAO on the treasury’s next steps.

Lessons learned:

Sky Mavis conducted several audits of its Ronin Network with independent auditors Certik and Verichains in the aftermath of the attack. It has since rebuilt the network with a few important changes, including a multi-tiered “circuit breaker” system that limits network withdrawal amounts, as well as updated Bridge Smart Contract software to limit daily withdrawals that allows for more administrative oversight. Overall, the hack reminded the space that Web3 systems need to keep on their toes regarding security and find ways to ensure the benefits of decentralization without compromising security.

The fall of Three Arrows Capital

Founded in 2012 by Su Zhu and Kyle Davies, the Singapore crypto-based hedge fund Three Arrows Capital (3AC) had a monumental fall from grace that began in June of this year. Known in the Web3 community for being notably bullish on Bitcoin, Zhu and Davies financed 3AC’s various investments in Web3 via some remarkably aggressive borrowing. Though this allowed 3AC to expand its reach throughout the ecosystem in the short term, the success of this strategy hinged on each of its investments appreciating in value.

Those investments included the algorithmic stablecoin TerraUSD and roughly $200 million worth of its sister coin Luna, both of which crashed in May. And while the company had managed billions of dollars in assets as recently as March, by early summer, Zhu and Davies were left with no way to pay back the significant amount of the debt they had taken on.

This quickly became evident when news broke that the company had defaulted on a loan from digital asset brokerage Voyager Digital worth over $670 million in crypto. Shortly after, a British Virgin Islands court ordered the immediate liquidation of the fund and its assets. Just days later, 3AC filed for Chapter 15 bankruptcy.

According to documents obtained by The Block, the bankrupt crypto hedge fund estimated its assets at $1 billion as of July, which was far outweighed by its liabilities, which stand at more than $3 billion. Among these assets were $7.5 million in NFTs, according to a tweet citing a now-defunct report on Dune. While this amount pales in comparison to the billions in crypto managed by the fund, a sizeable chunk of that NFT collection consisted of blue-chip NFTs. These included a collection of Art Blocks Curated NFTs totaling roughly $2.5 million in value, and a CryptoPunks collection worth more than $3 million.

The hedge fund’s founders had also collaborated with NFT collector VincentVanDough to start up Starry Night Capital, an NFT fund that hoped to put $100 million into the NFT community via a series of high-value purchases. This included the purchase of Ringers #879 for 1,800 ETH in August 2021, which at the time was valued at $5.9 million. One of the tip-offs that things were not well at 3AC came when Starry Night Capital consolidated a large percentage of its multi-million dollar NFT collection into a single wallet in mid-June, seemingly in preparation for liquidation.

The fallout from the hedge fund’s collapse was felt across the industry. The crypto exchange Blockchain.com faced a $270 million sting on loans it had given to 3AC, Voyager Digital filed for Chapter 11 bankruptcy due to 3AC’s inability to pay back that organization’s loan, and crypto financial service groups BlockFi and Genesis were similarly hit with major losses.

Lessons learned:

A combination of a summer fall in crypto prices with a highly-leveraged and risky trading strategy at the company ultimately exposed a liquidity crisis at 3AC, wiping out its assets and leaving it unable to repay creditors. Not entirely dissimilar from the recklessness that resulted in FTX’s downfall, Davies and Zhu’s imprudent bullishness and faith in the “number go up fast” philosophy that plagues so much of the crypto world proved to be their undoing. What’s even more disheartening are claims that Davies and Zhu now seem to be less interested in cooperating with liquidators’ asset recovery efforts and more concerned with preserving their reputations. Crypto has a reputation for being a kind of Wild West regarding financial plays, and 3AC’s fall hasn’t done anything to debunk that theory. Its collapse is a reminder to the space that, just because Web3 has opened up a new world of economic possibilities, unfettered greed can still be its ruin.

OpenSea’s tumultuous 2022

The largest NFT platform out there has had a bumpy ride this year. Along with some notable high points and commendable actions by the Web3 giant throughout the year, OpenSea saw its fair share of scandal and controversy in 2022.

On February 19, OpenSea users began noticing some strange activity on the platform. What they were witnessing was a hacker using a smart contract to interact with OpenSea’s then-new exchange contract to steal its users’ NFTs — a lot of them. The latent phishing attack, which saw the hack use a helper contract deployed 30 days prior, enabled the bad actor to make off with $1.7 million and some of the world’s most valuable and high-profile NFTs in just three hours.

In March, the company found itself in hot water after it initiated large-scale bans and takedowns of accounts associated with Iran in an attempt to comply with U.S. sanctions law. MetaMask was similarly forced to comply with Iranian transactions and sanctions regulations. However, the company failed to communicate the move in a timely and clear fashion to affected users, who took to Twitter to voice their frustration. The ban had also inadvertently locked out Iranian-born members who were no longer living in the country and had citizenship in other countries.

In June, the FBI charged a former OpenSea employee with insider trading. As insider trading has a long and storied history preceding the Web3 space, the arrest was one of the first instances of conventional laws being applied to punish bad actors in the NFT space. The employee, former OpenSea product manager Nathaniel Chastain, allegedly used confidential knowledge gained from his post working for the marketplace to commit wire fraud and was also charged with one count of money laundering.

Apart from a massive data breach on the platform in late June, the biggest OpenSea story that dominated headlines this year was when it floated the idea of eliminating royalties for existing collections on its platform in November. The news came alongside an announcement that OpenSea would be introducing a tool to enforce creator fees for new collections on the platform. The community celebrated this but worried that the platform would not offer existing collections — the collections that helped make OpenSea what it is today — the same protection. After the space’s biggest names rallied in support of maintaining royalties for those collections, OpenSea reversed its decision.

Lessons learned:

OpenSea is an overall positive contributor to the NFT space, and Web3 wouldn’t be what it is today without it. Its troubles in 2022 have highlighted a few important conversations, however, including the importance of decentralization and the degree to which its executed in the space, artist rights and empowerment, innovation, Web3 security, and more. It’s easy to criticize OpenSea, but its missteps are proving valuable to the evolution of the platform as it evolves and refines how it interacts with its artists and users. Perhaps the most valuable knock-on effect the platform has had this year has been to kickstart a sort of unionization movement in Web3 among artists, rejuvenating the ethos of artist empowerment the space has long touted as a founding and guiding principle.

FTX collapses, taking the crypto markets with it

Well, what to say about this one? Sam Bankman-Fried founded the crypto exchange FTX in the Bahamas in 2019, and the platform quickly grew to rival the biggest players on the scene, surpassing the likes of Coinbase in market share and even becoming a competitor to Binance, its former investor. In the process, SBF became a well-known crypto advocate in Washington for donating to campaign committees and other groups on both sides of the aisle (more than $40 million in total).

But SBF’s infamous fall from crypto fame came swiftly after leaked documents revealed a gaping hole in FTX’s balance sheet in early November. The documents also showed that FTX’s trading arm, Alameda Research, owned a suspicious amount of FTT, FTX’s native token. Though the sister company’s assets had been valued at $14.6 billion, crypto investors began to worry that the two companies were built on pillars of FTT-infused sand. Spoiler alert: they were.

An ongoing spat with Binance and its CEO Changpeng Zhao certainly didn’t help things, either. Following up CoinDesk’s report that shone a spotlight on FTX and Alameda’s extremely shaky finances were rumors that SBF had been denigrating Binance and CZ to regulators in Washington. Binance had been in possession of billions’ worth of FTT as part of its exit from FTX equity the previous year, and on November 6, CZ tweeted that he would sell the company’s FTT holdings in their entirety due to “recent revelations.”

All of this triggered a run on the exchange. Nearly $6 billion in withdrawals occurred in a 72-hour period, leaving FTX scrambling to find funds to cover it all. A briefly-floated buyout offer by Binance fell through, and on November 17, 2022, FTX filed for bankruptcy at a Delaware court. All told, SBF’s $16 billion fortune was reduced by 94 percent in a matter of days.

After weeks of wondering if SBF would be brought to justice for evaporating billions of dollars of customer funds and dragging down the Web3 market as a whole, the crypto community collectively breathed a sigh of relief when, on December 12, authorities in the Bahamas announced that the FTX CEO had been arrested. Just a day later, the SEC announced that it was charging SBF with defrauding investors.

Lessons learned:

The Web3 community is still feeling the pain from this one, with many in the NFT space still reeling from the exchange’s spectacular collapse. In the three days following the run on FTX, the largest 15 cryptocurrencies lost more than $176 billion in market cap, according to information gathered by Forbes. The damage done to crypto’s reputation is potentially even greater, with skeptics pointing to the event as further justification to denigrate Web3 in its entirety. The more valid critiques say that the fiasco is another reason why the crypto world needs to be more strictly regulated. If 2022 was the year of setting the basis for future regulatory activity, then 2023 will likely see those efforts expedited, and the space will have FTX to thank for it.

The mental health crisis in Web3

Though less tangible than the others on this list, it’s one that we have to mention. FOMO, FUD, bad luck, and being a part of a space that seemingly requires a 24/7 attachment to screens and devices have all done their part in contributing to a serious mental health crisis in Web3. None of this has been helped along by the 2022 bear market, which has dampened moods in the space overall.

Web3 Twitter, for example, is a fantastic place for NFT enthusiasts to gather and celebrate each others’ wins. It’s worth remembering, however, that toxic positivity can be very real, and without a proper acknowledgment of Web3’s low points and the daily struggle its participants endure, those celebrations are hollow.

Lessons learned:

Thankfully, several of the space’s biggest figures recognize this fact and are vocal in their advocacy of mental health. At nft now, we’re big supporters of the idea of zooming out and taking the space and your well-being into account to ensure you can consistently show up for yourself, and the people around you. The very real, very human struggles that 2022 presented everyone have taught us that community is more than just a trendy hashtag online, and that lessons are evergreen.

Source NFT Now