Once again, the calendar year is coming to an end. And in the United States, that means the financial year for most individuals is ending as well. With April 18 marked as the official due date for federal individual income tax returns, sadly, it is a day that brings confusion for, well, everyone. But over the last year, it’s become especially hard for people who are reporting gains from NFTs.

Don’t let the nerves get the best of you, though, since lawyers are readying themselves to assist in the broad variety of 2023 crypto tax needs. Hopefully, this year, those making last-ditch Google searches for “NFT tax loopholes” will instead find a wealth of information on how to report NFT assets, gains, and losses.

Of course, that doesn’t mean it will be the easiest thing you’ve ever done or that you shouldn’t take it seriously. After all, missteps can be costly (I should know… thanks IRS audit department). But there are answers. So, before you go claiming massive losses because you sold your PFPs far below market value, here are the key things that both creators and collectors need to know about taxes and NFTs.

How are NFTs taxed?

It’s important to understand how the IRS sees NFTs in 2023. Unfortunately, the U.S. tax code doesn’t formally address how NFTs should be taxed. But there are some guiding principles that have allowed experts to more or less suss out how things work.

To begin with, there’s a strong argument to be made that NFTs shouldn’t be claimed as “collectibles” according to the U.S. tax code. But NFTs are collectibles, right? So, why aren’t they taxed as such?

Because collectibles under IRC Section 408(m)(2) include:

- Any work of art,

- Any rug or antique,

- Any metal or gem (with limited exceptions, below),

- Any stamp or coin (with limited exceptions, below)

- Any alcoholic beverage, or

- Any other tangible personal property that the IRS determines is a “collectible” under IRC Section 408(m).

The use of “other” in the last item on the list makes it clear that collectibles must be tangible personal property. So while NFTs may be art, they definitely aren’t tangible. The jury is still out on this, but it seems pretty clear that NFTs aren’t taxed as collectibles.

Yet others, like U.S. Senators Cynthia Lummis and Kirsten Gillibrand, would like to see NFTs taxed as something completely outside the scope of collectibles. According to a proposed 2022 crypto bill penned by the two in which “digital assets” and “virtual currency” is strictly defined, NFTs could do well to be treated as commodities (like petroleum, cotton, soybeans, etc.) rather than as securities.

This means that NFTs would fall under the purview of the Commodity Futures Trading Commission (CFTC) rather than the Securities and Exchange Commission (SEC). But while the aforementioned bill attempts to regulate digital asset exchanges, taxpayers likely won’t feel any of its ripples while reporting their NFT taxes from the 2022 season.

So, for the most part, experts think that NFTs should be treated more simply and considered adjacent to the infrastructure that already exists for fungible cryptocurrencies like Ether and Bitcoin. But if we take another step down the ladder, we can’t discount that crypto is often viewed the same as stocks — more like property.

In short, according to the IRS, NFTs are also taxed alongside crypto as property. While we could continue to speculate for another year whether tokens should or shouldn’t be considered collectibles or commodities, traders simply need to know that NFTs are subject to capital gains tax.

Capital gains taxes and NFTs

In essence, a capital gains tax is a tax placed on profits earned from the sale of any asset that has increased in value over a holding period. That…is a bit of a mouthful. An easier way to put this might be to say: If you mint an NFT at 0.08 ETH and then sell it for 2.5 ETH a few months later, that creates a taxable capital gain because you made money (or capital).

Yep, buying an NFT low, holding for a few months, then selling high is taxable, and quite significantly. But this applies to losses as well. So, if you purchased an NFT for 2.5 ETH and sold it at 0.08 ETH for a final loss of 1.7 ETH, guess what — that’s a capital loss.

So whether you’re a creator or a collector who dabbles in trading NFTs, you need to know that capital gains and losses don’t just happen when you exchange crypto for fiat currency. They happen when you buy and sell NFTs. Sure, that might seem a bit contradictory, considering the decentralized ethos of the NFT space. But as the IRS outlined in Notice 2014-21, the value change of any given cryptocurrency can create a capital gain or loss.

Whether you are selling an NFT, swapping one coin for another (like ETH → APE), or cashing out crypto for USD, most of your transactions are likely to be considered taxable events. And these gains can accrue a serious markup when it comes time to settle up with the IRS. But here’s the thing: In the eyes of the IRS, the length of time you’ve held onto an NFT makes a big difference in how it is taxed. This is where the length of HODL becomes important.

Say you hold an NFT for less than a year, and then you sell it for more than you paid. This is called short-term capital gain. These are generally taxed at the same rate as your regular income. According to the 2023 tax brackets established by the IRS, that will be somewhere between 10 to 37 percent.

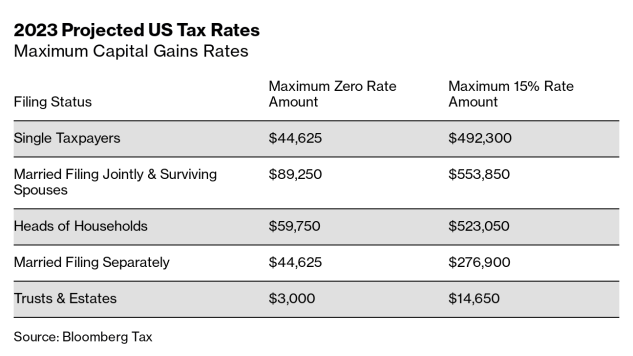

Long-term capital gains, on the other hand, are taxed less. Since NFTs have only been popular for the better part of two years, this one’s a bit tricky. If you did end up holding an NFT for more than a year, that’s a long-term capital gain and is taxed at 0, 15, or 20 percent, depending on the value.

Although the 2023 capital gains tax threshold has yet to be officially released, Bloomberg outlines the projected 0 and 15 percent rates in the image below. For the most part, this is where general NFT traders will be (unless you made a serious six- or seven-figure killing this year). Consult Form 8949 (specifically “Sales and Other Dispositions of Capital Assets”) for more on this.

How to calculate your NFT taxes

To the IRS, the circumstances of your NFT purchases all matter. As attorney Jacob Martin explains in his NFT Tax Guide, you’ll need to consider things like the length of time you held your crypto before buying an NFT, what the price of your preferred coin was when you bought in vs. when you purchased the NFT with it, how long you held the NFT, the price difference when you bought the NFT vs. when you sold it, how long you held the crypto post-sale, and so on (hopefully, you get the idea).

Also, be sure to check whether you purchased an NFT with USD instead of crypto. This is a non-taxable event, and one that has been increasing in popularity with the advent of credit card checkout via platforms like Nifty Gateway.

But, while the mode of purchasing an NFT can dictate if it is taxable, selling an NFT is always a taxable event. NFTs are considered sold anytime they are traded for USD, other tokens (ETH), or used to purchase something else. And yes, this applies to pawning NFTs, fractionalizing NFTs, and even swapping an NFT for another NFT.

NFT taxes for creators

What we’ve talked about in the first half of this guide mostly applies to NFT collectors. Whether you identify as a collector or trader (or not), if you’re buying and selling NFTs, the above info could help you understand what sort of information you need to have on hand for filing taxes. For NFT creators, though, things are a bit different.

If you’re trading NFTs, which most artists do in addition to creating and selling, you’ll need the information above. But there’s more to know when it comes to gains accrued through the sale of your own original art. Fortunately for artists, though, it’s all very simple from here.

Creating an NFT is not a taxable event, but selling that NFT is. The general rule of thumb to follow as an NFT artist/creator is: when you sell an NFT, you will have to pay taxes on the profits. Profits for NFT creators are not considered gains, rather, they’re income. And this income will be taxed at your regular income tax rate. For self-employed individuals, this rate is 15.3 percent. Even if you were paid in crypto peer-to-peer and not via a marketplace transaction, this is considered income (just like selling a print of one of your works) and is taxed as such.

It’s important to note that self-employment tax is different than your regular income tax rate of 10 to 37 percent. You’ll need to determine how much of your net earnings from the year are subject to self-employment tax. For a bit more on this topic, NerdWallet has a great explainer to help any self-employed individual get the jump on taxes.

If you’ve engaged in any NFT-related charitable giving throughout the year, for example, by donating one of your NFTs to a museum or an auction house for a good cause, things get a bit stickier than simple self-employment taxes. In this case, be sure to consult our full, lawyer-written article on the topic here.

Otherwise, be sure to remember: Self-employment taxes are the way to go, and NFTs that you bought or sold, but didn’t create, will be subject to the capital gains tax explained earlier in this guide.

Are you ready for Tax Day?

So, taxes aren’t so scary…right? They are definitely complicated and will take a lot of time to complete (especially if you’re an active trader with lots of transactions), but all in all, they’re doable. If your 9,999 fellow PFP owners can do it, so can you!

If you’re still a bit confused though, consider doing a bit more research into NFT taxes on your own. Martin’s aforementioned NFT Tax Guide is a great place to start — although you will need to spend a bit of ETH minting an NFT to gain access to the full guide. Or better yet, ask around the NFT community to see if someone will loan you their guide for a while.

In all honestly, the best way to do your taxes in 2023 may be to consult a tax professional. Remember, nft now is not offering you tax advice, but companies like ZenLedger and Taxbit offer great services to help those within the crypto, NFT, and DeFi spaces with their taxes. Once 2022 comes to a close, it’ll be up to you to get your taxes sorted.

Source NFT Now