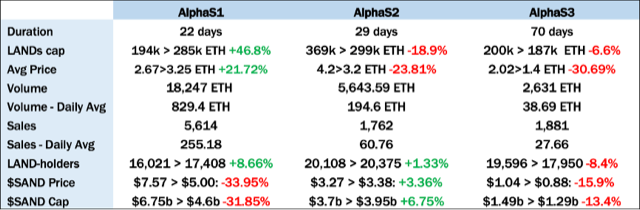

The Sandbox’s 10-week Alpha Season 3 concluded Nov 1, and, as promised, below is the comparative data and analysis of the three Alpha Seasons to date.

Though elsewhere you may find analysis of the Seasons from a gaming, player and/or rewards earned perspective, here at OneLand, we break down the impact on the LANDs market.

All Alpha Seasons provided Play-2-Earn incentives for holders of Alpha Passes, which could be obtained either through holding LAND, entering Season Raffles, participating in social contests or buying off OpenSea.

Alpha Season 1 kicked off on Nov 29, 2021 following four years of development and ran for 22 days. Coinciding beautifully with Facebook’s rebranding to Meta one month earlier, it instantly propelled The Sandbox into one of the world’s most popular blockchain games.

The 7.5-week period from Facebook’s rebrand up till the end of AlphaS1 saw The Sandbox’s most explosive period of growth to date. Honing in on the Season itself, LAND cap and LANDholder numbers rose 46.8% and 8% respectively in just 22 days, while daily average volumes reached 830 ETH.

Notably, $SAND hit its ATH of $8.44 just 4 days prior to the Season’s launch and spent the 22 days correcting, falling 34%.

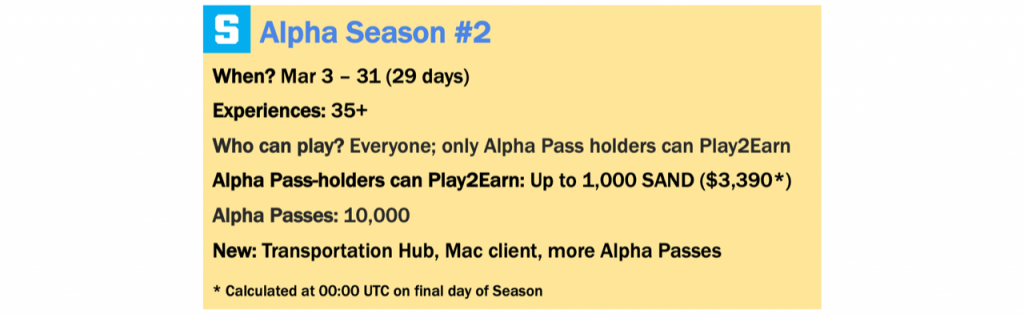

By the time Alpha Season 2 rolled round on Mar 3, SAND’s value and market cap had corrected significantly, while The Sandbox’s LAND cap had just hit its ATH of 379,546 ETH a week before.

The Sandbox’s recent market surge had been dramatic and popularity in the project was surging. So though LAND-holder numbers were still rising, the speed at which they were doing so was slowing, and the market would need more time to realize this was going to be far worse than a correction.

The market was slipping. The average price of LAND over AlphaS2 were 0.45 ETH higher than, though sales numbers were less than a quarter of, those of AlphaS1.

This time round, the Season included twice the number of experiences, and (perhaps learning lessons from its last Season) granted full access to Alpha Pass holders and non-holders alike. Besides, it afforded players an extra week of game time to relish the experience.

Nevertheless, deteriorating market conditions were a spanner, and despite spiking volumes on the Season’s kick-off date registering its highest daily volume in a fortnight, AlphaS2 was not even close to recording anywhere near the success in the LANDs market of AlphaS1.

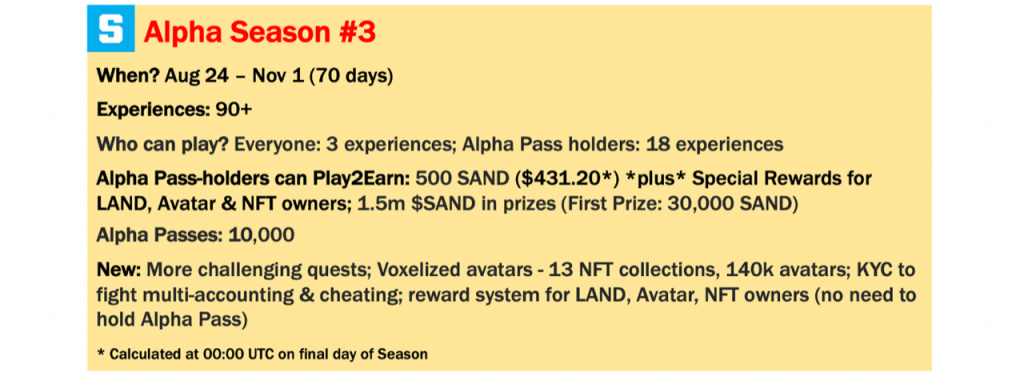

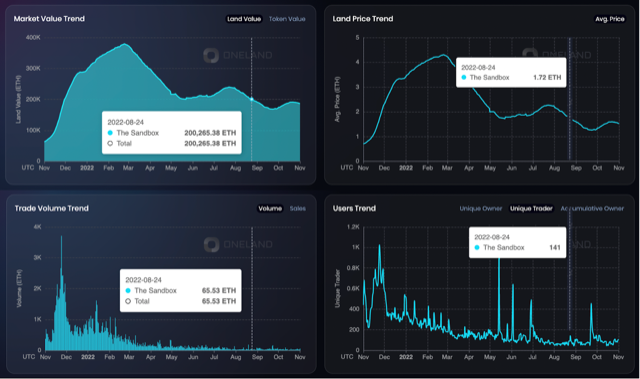

Alpha Season 3 was by far the biggest, most accessible, most rewarding and longest-running Season to date. It kicked off deep in the middle of a crypto winter with The Sandbox’s LANDs cap in free-fall, hitting a low on the first day (in ETH terms – 200,265.38 ETH) not since (apart from one day in May) since the first day of Alpha Season 1 on Nov 29, 2021. Things were about to get worse.

Zooming out on the 10-week AlphaS3 in the context of the past 12 months, and a few things become clear.

First, the Season’s launch failed to stem a further dangerous downturn in the LANDs market, noted in its continued decline in LANDs cap and average price.

Second, if the current bear market was not bad enough, even falling token prices (ETH crashed 29%, and SAND fell 17% in an 11-day period from pre- to post-Merge) nor a depreciating average price could rally the buyers. That was, until a LANDholder-exclusive staking program that kicked off on Sep 22, including delicious incentives of 3 million $SAND, provoked spikes in volume and sales that led to a rejuvenation across major metrics for the first time since July.

The one metric that suffered across the entire 10-week AlphaS2 was the number of holders of LAND. Holder numbers had peaked back on May 18 at 22,262 and since dropped to 19,596 by the first day of the Season. And the first four weeks (Aug 24-Sep 21) saw a marginal increase in unique holders of LANDs, up 0.22% to 19,716.

But as soon as the staking program launched, numbers crashed – from Sep 22 to the end of the Season, holder numbers fell 9% to reach its lowest figure since January. The staking program brought home the truth of who was buying LAND during AlphaS3 and it was not new investors to The Sandbox, but existing holders consolidating their positions. Across the 10 weeks of the Season, unique holders fell 8.4%.

Source NFT Plazas