ine days into their honeymoon in December 2018 in Jaipur, India, Gerald Cotten and Jennifer Robertson made an emergency trip to a private hospital. Cotten had come down with a severe stomachache, and after a diagnosis of acute gastroenteritis, his condition worsened severely. Blood tests pointed to septic shock as the culprit. His heart stopped.

Despite doctors’ best efforts, Cotten was declared dead just 24 hours after his stomachache had begun.

As the CEO and Co-Founder of QuadrigaCX, Canada’s then-biggest Bitcoin exchange, Cotten’s death soon made international headlines. But not just because of his status in the crypto world. While his will detailed millions in real estate holdings and other assets, it left no mention of the cold wallets that stored most of Quadriga’s funds — which totaled $250 million in cryptocurrency. In April 2019, the Nova Scotia Supreme Court declared the company bankrupt, since the exchange had ceased to function three months earlier.

Cotten’s story is one of the crypto world’s most intriguing, containing all the elements of a great mystery novel: fake identities, Ponzi schemes, international investigations, greed, disappearance, and death. It also exposes one of the decentralized world’s weaknesses, raising an uncomfortable question: What happens to a person’s crypto and NFTs when they die?

NFTs and crypto after death

To the Web3 user, forever losing digital assets to inaccessible wallets is a nightmare scenario that rivals losing everything to rug pulls and other scams. But while losing crypto and NFTs due to poor estate planning is hardly any different, it’s less likely to be on people’s minds. The technology is still relatively new, and people don’t like to think about death in general.

“There are people who don’t want to deal with their own mortality,” explained Asher Rubinstein, a partner at Gallet Dreyer & Berkey in New York City who specializes in domestic and international asset protection, wealth preservation, and estate planning in an interview with nft now. “It’s a difficult issue to deal with. What happens when I die? Some people just don’t even want to face the question.”

But assets are still assets, digital or otherwise, and having a proper plan in place to handle their distribution post-death is key. And the stakes go beyond the personal level: Bitcoin’s total circulation is unlikely to reach its stated limit of 21 million due to early adopters who either died and had no plan for succession or lost their private keys forever. And while the overall trend is encouraging — nearly 70 percent of financial planners who took part in an estate planning survey conducted by TD Wealth this year said they’re now incorporating digital tools into their clients’ estate plans — the issue is still one that deserves more attention than it gets.

Digital asset security and accessibility

The problem of digital asset distribution comes from the decentralized nature of the blockchain. The most basic principle of Web3 security is not to give away your private keys, even to friends and loved ones, because there’s just no centralized authority to come to the rescue should something go awry. Legal experts like Rubinstein, whose clients include prominent blockchain company founders, help people strike the fine balance between security and accessibility regarding crypto asset management and inheritance. Ultimately, there’s no perfect way to go about it, but when it comes to the law, Web3 users need to know their options.

“An attorney who is cognizant of digital assets will know what to do with your digital assets, just like he or she should know what to do with your home,” Rubinstein underlined. “There are two ways to go here: Do we need a will? Or do we need a trust?”

“Do you really want your will and your assets, including your digital assets, to be made known to the public?”

ASHER RUBINSTEIN

Doing nothing, Rubinstein emphasizes, is the worst thing you could do. While state laws in the U.S. account for intestacy (the circumstance of death in which no will or trust is provided), this requires the state’s intervention, meaning the government will distribute your assets according to the law. Putting digital assets into a will is the next best option, necessitating expensive legal proceedings and public hearings. It’s this public nature, Rubinstein noted, that most Web3 advocates use blockchain tech specifically to avoid.

“[With a will,] your next of kin has to hire an attorney to go through the probate process,” Rubinstein elaborated. “And it’s public. Do you really want your will and your assets, including your digital assets, to be made known to the public? You’ve also created a forum where somebody can go and challenge your will. My experience with clients who are in the crypto realm is that they don’t want the court to know where their crypto is. They don’t want the public at large to read their will and see where their NFTs are located or what they own in the digital world. Wills are not wrong, per se, for estate planning, but they do have inefficiencies. There’s a better way — a trust.”

Managing digital inheritance with a trust

Managing digital asset inheritance with a trust comes with some significant benefits. One is that it bypasses courts. Apart from the public nature of the court system, the judicial systems that handle wills can be remarkably slow-moving. To probate a will in New York City, for example, courts don’t even begin the process until six to nine months after a death occurs. If a will includes volatile cryptocurrencies, inheritors can win or lose entire fortunes in that time.

When setting up a trust, it’s also critical to know how well-versed a trustee is in digital currencies and NFTs. If they don’t know how to access your wallet, your post-mortem digital assets could be in trouble. To avoid this situation, the best thing to do is to write something into the trust that empowers the trustee to hire the kind of person who does have expertise with digital assets.

“Most people don’t want to part with custody and control over their digital assets.”

ASHER RUBINSTEIN

Trusts aren’t a perfect solution either, as they involve sharing private keys with or transferring digital assets to a trustee, and most are reluctant to share that kind of information if there’s even a slim chance that it somehow gets out.

“Most people don’t want to part with custody and control over their digital assets,” Rubinstein conceded. “They want to retain control over their digital assets until they die. And they might not share their keys with the trustee. But they might leave behind instructions on where the trustee could find those keys, for example, in a safety deposit box.”

However, there’s a healthy debate in the Web3 community about whether the safety deposit route is a good one, since you’re ultimately storing your keys with a centralized authority that can change the rules surrounding its safety deposit system at any time.

Crypto estate planning: the legal vs. the technical approach

Some Web3 protocols are attempting to bring a technical solution to the issue of digital asset dispersal in the event of someone’s incapacitation or death. The Sarcophagus protocol, which acts like a digital dead man’s switch, is one of them. Users can store documents or messages that automatically reveal themselves to a designated recipient if that user stops signing cryptographic messages (as a sign that they’re alive and well).

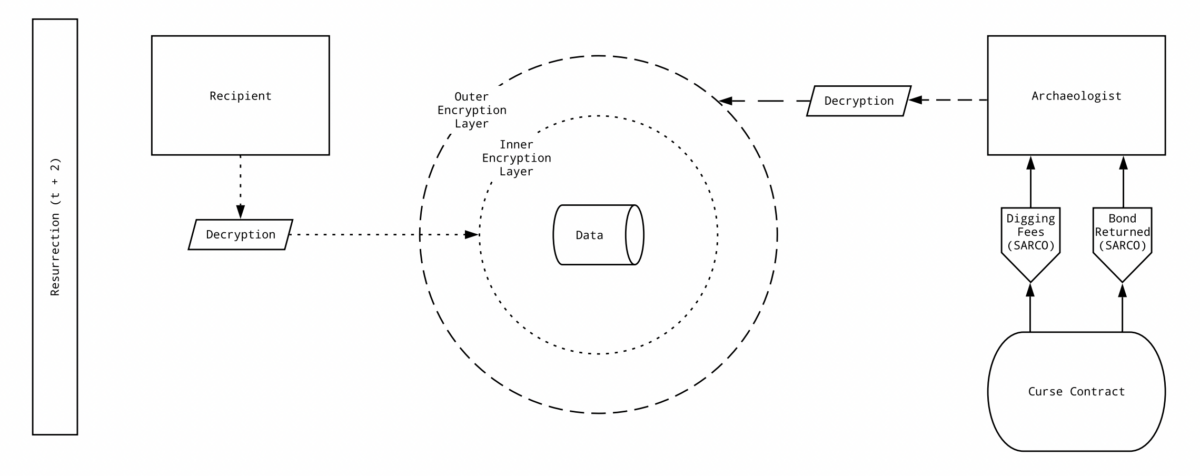

Essentially, Sarcophagus layers an encrypted data storage unit (which could be composed of documents, messages, or other data) with a trigger that releases upon the inaction of a user. For example, users could set it up to enact if they don’t access their wallet within a specified time. The system relies on three types of individuals: creators (also called embalmers), recipients, and archaeologists.

In the context of asset inheritance, the embalmer is the person who wants to pass on their digital assets. They create the Sarcophagus switch and encrypt the data they want the receiver to obtain in the event of their inaction. The recipient (represented by an ETH address) can receive the encrypted file at “resurrection time,” a time determined by the embalmer (say, any number of hours or even years after their inaction has been noticed by the system). This time specifies when the data is available to be decrypted in case the embalmer fails to perform the digital signature.

Recipients can only decrypt the inner encryption layer of a sarcophagus, however. First, an archaeologist needs to decrypt the outer layer. Archaeologists are actors in the Sarcophagus network that run nodes to observe whether sarcophagi need to be decrypted. They also stake SARCO tokens (the protocol’s native token) that can be slashed if they decrypt too early or late or otherwise act outside of the terms of the agreement between the embalmer and archaeologist. Assets in a portfolio can also be transferred to a specified wallet address by putting a signed (but unpublished transaction) into a sarcophagus. The recipient(s) then publish that transaction to execute the inheritance.

It’s a clever system that could be applied to several situations ranging from password recovery to emergency communication to political activism. And while its potential for aiding the inheritance of digital assets is also compelling, technical solutions don’t necessarily override the necessity of proper legal counsel and wisdom in these matters.

“We live in a society where ingenuity and creativity are rewarded,” Rubinstein said while commenting on technical solutions like Sarcophagus. “People have had to do their estate documents for hundreds of years. And many people think, ‘Well, do I need a lawyer to do this? Let me find a way to have technology do it for me.’ I’m skeptical because unless there are lawyers behind the technology, then I’m going to question whether all the I’s are dotted and the T’s are crossed with regard to the law. If a tech company is providing an alternative to proper estate planning documents, then we have to ask whether what the tech company is doing is proper and complete.”

Managing your digital assets in life

Thinking about and taking steps to manage your crypto and NFTs is an ever-evolving process. Web3 moves fast, so it’s a good idea to reflect on how you handle your digital assets with some frequency. The Internal Revenue Service (IRS) and the Securities and Exchanges Commission (SEC) regularly release statements that update their position on crypto and NFTs. Keeping an ear to the ground for those is vital.

While the blockchain has created a new, largely decentralized world, Web3 enthusiasts shouldn’t make the mistake of thinking that it’s a world beyond the reach of the government. The Department of Justice has shown that it’s not afraid to go after fraud in the space, and the IRS is well-known for its international reach.

“I would not put DeFi and anonymity above the obligation to abide by the law.”

ASHER RUBINSTEIN

“The IRS has tentacles around the world,” said Rubinstein on the establishment and implementation of the Foreign Account Tax Compliance Act (FATCA). This 2010 law requires sovereign governments to sign on to enforce U.S. tax law overseas by giving information to the IRS. “You should never assume that the government is stupid or technologically deficient. Look at how the FBI and other law enforcement agencies are actually able to determine how blockchains have been hacked.”

The IRS recently updated its tax law to include NFTs in the same category as cryptocurrencies, saying that those who have “disposed of any digital asset in 2022,” whether by exchange, sale, or transfer, will have to report and pay capital gains tax accordingly.

“Yes, we’re talking about the world of DeFi, but I would not put DeFi and anonymity above the obligation to abide by the law,” Rubinstein underscored. “You need to keep records of your purchase price of cryptocurrencies or NFTs because when you sell those assets, you have to pay tax on any gains. And I don’t think it would be prudent for you to think that the government will never find out that you sold those assets and made income.”

Overall, expect regulation regarding digital assets to change as the U.S. government grapples with crypto and NFTs and what they mean for society at large. So far, that process has been far from a smooth one. For personal estate planning and proper management of your digital assets, while you’re alive, the best advice seems to be to plan for the worst and hope for the best.

Source NFTnows